Daily HI4E.org Trivia Contest Winners For The Week Ending: Sunday, February 24th, 2019.

In an effort to broaden the company’s “social interaction” with our clients and FaceBook fans, Daily Trivia Questions are posted on both of our business pages. Here are the weekly standings for this past week, and the winner of the Sunday night Weekly Drawing for an AmEx gift card!

Congratulations – To this past week’s Trivia Contest Winner!! Our latest contest winner for the weekly FaceBook HealthInsurance4Everyone/Health & Life Solutions, LLC Trivia Contest, drawn randomly by computer late Sunday evening, February 24th, 2019 was:

TESSA DAVIS

Winner Of A $25.00 AmEx Gift Card

Each day, fans who have “liked” either of our company FaceBook pages (HealthInsurance4Everyone or Health & Life Solutions LLC) are able to test their skills with our Daily TRIVIA QUESTION. The first 20 winners who post the correct answer to the TRIVIA QUESTION, will then get entered into the weekly drawing held late on Sunday evenings for a $25.00 Am Ex Gift Card.

Weekly Gift Card winners will be posted in our blog at this site. Remember to become a FaceBook fan and “Like and Follow” either of our company pages to enter and post your answers.

Here are the daily contestants from last week’s Trivia Contest that were entered into the Sunday drawing:

The trivia drawing entries 2/18/19 thru 2/24/19 are:

2/18/19

Jodi Stevens

Karen Brunet Moore

Kimberly Snyder

Brandy Marie

April Ashcraft

Jill Nauyokas

Carrie Vucinaj

Sheila Carvell

Kim Avery

Heather Wheeler Shaw

Lisa David Carr

Tonya Velazquez

Jennifer Ramlet

Jenifer Garza

Kathleen Hickman

Tessa Davis

Kristina Harris

Lenis Abshire

Vickie Gipson

Stacy Nelson

Amie-Lee George

2/19/19

Hayley Cordaro

Kimberly Taylor Hall

Nacole Patrick

Mike Adamski

Karen Brunet Moore

April Ashcraft

Tracy Shafer

Kim Avery

Joann Tompkins-Winborn

Brittany Light

Christine M Miller-Borowczyk

Jill Nauyokas

Bea Patrick

Michelle Webb

Angela Janisse

Brooke Scott

Ashley Agner

Tracy Heyer

Alyssa DiFazio

Sheila Carvell

2/20/19

Nicole Blaha

Jennifer Ramlet

Patricia Oehlert Vazquez

Brooke Scott

Jenifer Garza

Dale Fish

Traci Anderson

Rosanne Clark

Holly Cajigas

Maria Skoytellis

Connie Lynn Merritt

Amber Conaway

Derek Jennings

Heather Wheeler Shaw

Megan Rhyne

Beth Johnson Titus

Melissa Barnes Walker

Angela Janisse

Tracy Heyer

Morgan Alexandra

Nelle Bailey

2/21/19

Jill Nauyokas

Be Schwerin

Jenifer Garza

Nacole Patrick

Kellina Fernell Murphy

Nicole Blaha

Christy Hawkes

April Ashcraft

Karen Bondehagen

Stevie Rosson

Priscilla Shimp

Harley Magoon

Melissa Mae

Bea Patrick

Kayla Hernandez

Derek Michelle Polk

Jean Simmons Homfeld

Patricia Oehlert Vazquez

Stephanie Marie Walls

Shannon Scott

2/22/19

April Ashcraft

Alyssa DiFazio

Tiffany Greene Elliott

Jill Nauyokas

Eleazar Ruiz

Marilyn Wall

JR Eddington

Ashley Agner

Jennifer Ramlet

Maria Bouchard

Brandy Marie

Britta Brown Lawson

Mike Adamski

Jeremy Mclaughlin

Dawn Raasch

Sarah Harrison

Kendra George

Althea Thomas

Eva Biggs

Kathleen Hickman

2/23/19

Jill Nauyokas

Jenifer Garza

Amber Chandler

Christy Marie

Joann Tompkins-Winborn

Jakara Jaxn

Alicia Johnson

Josephine Casey

Thalia BinBunz

Angela Janisse

Diane Hamric

Donna Porter

Karen Brunet Moore

Dale Fish

Lori Sexton Leal

Alexis Maureen

Tonya Velazquez

Brooke Scott

Thomas Ryan Gan

Rosanne Clark

Shannon Scott

2/24/19

Andrea Timms-Hill

Kim Avery

Jill Nauyokas

Vickie Gipson

Brandy Marie

Carl Buddy Mizell

Geri Rus

Adaria Johnson

Rebecca Hueller Crum

Dale Fish

Brandi K Chaney

Wayne Gallas

Jennifer Alford

Angela Janisse

Christy Marie

Jennifer Ramlet

Sarah Bellestri Shih

Pam Johnson Rowland

Alisa Jones

Kimberly Snyder

Be sure to watch both of our FaceBook pages for your chance to win and enter again next week, with questions posted daily on HealthInsurance4Everyone or at Health & Life Solutions, LLC!!

Remember that if you try your hand at answering the Trivia Question several days each week, your odds of winning the Sunday weekly drawing are much better.

Also note that a number of the posted answers each day are from contestants who have forgotten to “Like” one of our pages, so their names WILL NOT be entered at the end week drawing for the gift card, giving our fans a better chance!

You may also find that if you “Like” BOTH of the business pages, you will receive faster notifications of the other players as they post their answers to compete with you!

—————————————————————-

At Health Insurance 4 Everyone, we not only want to improve our customer service but also interact with our customers on a social media level that wasn’t available before. Interested in connecting with us? Look us up on….

Twitter: Healthinsurane4 (Follow Us On Twitter To Receive Faster Notifications When Daily Trivia Questions Posted, & To Be Immediately Notified When Weekly AmEX Gift Card Winners Are Announced!!)

Click-On for LinkedIn To Follow Our Posts: LinkedIn

Like us on facebook: HealthInsurance4Everyone or Health & Life Solutions, LLC

Over 54,000 Combined Fans/Followers To Our Social Media Sites, & We’re Growing Daily!

Follow Mark Shuster, Founder/Owner at Health & Life Solutions, LLC for daily health tips!

Mark Shuster FaceBook Link

Follow our word press blog and read about everything from health insurance and reform news to healthy living and current events!

Company Blogs

Find out more about LegalShield, our corporate partner which gives you the power to talk to an attorney about any legal issue, and offering high-quality Identity Theft plans.

LegalShield

Read more

These Five (5) Questions May Hold The Answer….

Going without coverage can be tempting and even seem necessary at times, especially when you are relatively young, relatively healthy and on a relatively tight budget. However, skipping major medical coverage can also be a potentially costly decision. You may wind up owing a tax penalty (yes, even now that the Trump Administration is in office), paying unexpected medical bills out of pocket, or both.

If you are asking yourself if you really need insurance, the answers to these five questions may help you decide.

If you are asking yourself if you really need insurance, the answers to these five questions may help you decide.

1. Are you exempt from the ACA’s individual mandate?

The Obama ‘Affordable’ Care Act’s individual shared responsibility provision (aka, the individual mandate) requires most Americans to have a health plan that qualifies as minimum essential coverage. This may include, but is not limited to, job-based coverage, major medical plans purchased on and away from the state-based and federally facilitated health insurance exchanges, Medicaid and most types of TRICARE (veterans) coverage.

However, exemptions from the mandate are granted to individuals in certain circumstances, including those with coverage gaps of less than three consecutive months, those for whom coverage costs more than a certain percentage of their household income, those with incomes below the filing threshold and others facing general hardship, to name a few.

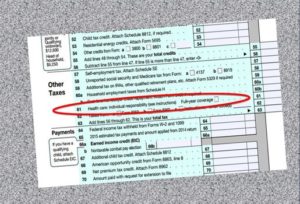

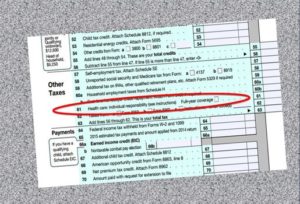

If you are not exempt and do not obtain coverage as required by the law you could face a penalty known as the shared responsibility payment at tax time.

What could being uninsured could cost you if you’re not exempt?

You may owe a tax penalty known as the individual shared responsibility payment. Those who went without minimum essential coverage in 2016 could face penalties as high as follows: that penalty could be as high as :

- 2.5% of their annual household income above the tax filing threshold to a cap of the national bronze plan s premium, or

- $695 per adult and $347.50 per child under 18 to a maximum penalty of $2,085 per family.

For every month that you are uninsured and not exempt, you owe 1/12 of the annual shared responsibility payment.

In 2017 and beyond, the penalties remain the same, but will be adjusted for inflation.

2. How will you pay for healthcare if you need it?

While we know it can happen, we never really plan on becoming ill or getting injured, especially when our medical histories are relatively spotless. If you have no benefits to help with covered expenses when you do get sick or hurt and need medical care, you will have to pay 100% of the bills out of pocket. Whether your healthcare expenses are expected or not, do you have access to savings, credit or other funds to help pay for healthcare?

What could being uninsured cost you if you need healthcare?

Insurance status has a strong association with medical bill difficulties—more than half of uninsured individuals report problems paying household medical bills. On average, a trip to urgent care will cost $150 and a trip to the emergency room will cost over $1,000. Fixing a broken leg can cost up to $7,500 and the bill for a three-day hospital stay hovers around $30,000.

3. Do you plan on being uninsured for short time?

Accidents and illnesses can happen any time, not just when it is convenient. Even if you are about to start a new job with benefits that kick in a month or two down the road, it is wise to have a plan for how you will pay for healthcare in the meantime.

Short term health insurance plans provide temporary coverage for as few as 30 days. They offer a range of benefits to help with covered expenses, including office visits and emergency care, and they can be quickly obtained. Application and enrollment take only a few minutes, and coverage begins as early as the day after you enroll. You can buy short term coverage year-round.

What could a short term health plan cost you?

Typically, short term plan premiums are a fraction of major medical premiums. Keep in mind that short term plans are not the same as Obamacare plans (i.e., major medical insurance). They are not subject to the ‘Affordable’ Care Act, which means you may be denied coverage based on your health history and, if you are not exempt from the shared responsibility provision, having short term coverage will not prevent you from owing a tax penalty.

If you plan to be uninsured longer than three months and do not qualify for a special enrollment period, you may consider a hospital indemnity plan.

Learn about HIP (Hospital Indemnity Plans)

4. Will you qualify for an Obamacare subsidy?

If you buy a major medical plan from a state-based or federally facilitated health insurance exchange (the Obamacare plans) and meet certain income qualifications, you may be eligible for a subsidy. Obamacare subsidies include advanced premium tax credits that help lower your monthly premium payment.

Remember: You can only buy major medical plans during the annual open enrollment period or during a special enrollment period if you have a qualifying life event.

What could health insurance cost you with an Obamacare subsidy?

Major medical health insurance premiums vary depending on a number of factors, including where you live, what type of plan you choose (i.e., bronze, silver, gold, platinum), and your age. In 2016, the average premium for health insurance plans purchased through the federal Obamacare HealthCare. gov exchange was $408 per month.

However, 83% of people who purchased healthinsurance through HealthCare. gov received subsidies that helped lower their monthly premiums. The average advanced premium tax credit amount was $294 per month, which lowered the average monthly cost to $113 per month.

Consider “Gap” Insurance To Cover The Higher Obamacare Plan Deductibles & Out-Of-Pocket Limits

5. Are you eligible for Medicaid?

In 2014, Medicaid eligibility was expanded to include single adults earning up to 133 percent of the federal poverty level. Not all states decided to participate in this optional expansion. You can enroll in Medicaid year-round. To view your state’s eligibility criteria, click here to visit Medicaid.gov’s State Medicaid & CHIP Profiles page.

What could Medicaid coverage cost you?

If you qualify for Medicaid, you may be able to get low-cost or no-cost coverage.

The Obama ‘Affordable’ Care Act may require you to buy health insurance, and there may be financial risks in going without it. Ultimately, you must decide if you need health insurance. It is important to understand all of the benefits and risks associated with your decision. Work with a health insurance producer to determine the right coverage  options for your health and financial situation.

options for your health and financial situation.

You can call the number at the top of your screen to speak with a certified advisor (i.e., health insurance producer) who can assist you. You can also obtain quotes for supplemental products, short term coverage and off-exchange Obamacare plans at :

HealthInsurance4Everyone – www.hi4e.org

Read more

If you are asking yourself

If you are asking yourself